They say you shouldnt fall in love with your investments

They say you should never fall in love with your investments or a given share. Over the past couple years AngloGold (ANG:JSE, AU:NSYE) and Goldfields has been good to me. This year … not so much. So I decided to look into ANG and see if I was “in love with my investment” or if the market is under pricing it (in my opinion)

So I went and got ANG’s results. Firstly I decided to look at how much it costs to pull the stuff out of the ground. They have mines throughout the world. I have listed them in order of ounces produced per year with the cost / oz.

| S.A | USD 637 | Prev: 616 |

| Continental Africa | USD 819 | Prev: 790 |

| Americas (mostly south) | USD 480 | Prev: 465 |

| Australia | USD 1153 | Prev: 894 |

With gold for the past quarter ranging from 1150 to 1500 USD these guys should be printing money and their last results show this …

| Q1 2011 | Q1 2010 | |

| Revenue (Mill ZAR) | 10,402 | 8,453 |

| Net Profit after tax (Mill ZAR) | 1,701 | 1,238 |

| Basic Earnings per share (EPS) | R4,30 | R3,13 |

Lets look at the increase here. Their EPS is up 37.3% yet their share price has gone down! Curious! You can convert to dollars they say in their statement 6.99 for Q1 2011 and 7.50 for Q1 2010. similiar story.

Lets look at properties. Its no secret that SA’s mines are suffering from strikes, elec shortages and reducing grades but they are still very profitable at currents costs and gold prices. What I like is that ANG is replensishing its reserves. At this stage through drilling and exploration of properties it owns and one of the main places they are looking is Ghana. The country has rich gold veins that are known about and there are also inferred resources available. This investment into future production is something I like about the company.

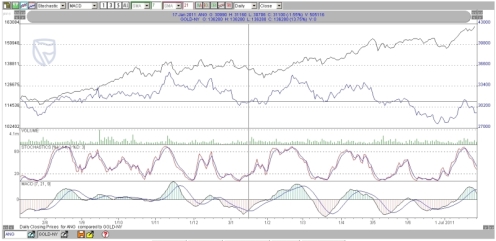

Look at the chart below. UP until about 8 months ago there was a corrolation between the gold price (black line) and the share price (blue line) This seems to have dissconnected.

So why is this happening. I have two theories.

Firstly I dont think that the world believes that the gold price is sustainable or that higher gold prices are here to stay. Bernake believes that gold ISNT money, most financial advisors still tell people that gold is risky (its gone up on avg 22% each year for the past 10 years … so risky!) and that they should hold 5-10% as a hedge in their portfolios. So people are not believing in the gold market. This tells me we are still in phase 2 of the gold bull.

Secondly the equity markets have been showing weakness in light of the soverign debt crisis that are finally coming to the public eye. Some people are going to gold for saftey but this is a fear trade and many expect gold to fall when the “problems” are resolved (IE bailout the PIIGS and raise the US debt ceiling) Meanwhile gold equities are behaving as if its 2008 again. They are being treated like every other stock and are dropping.

In short it looks like a perfect financial storm for gold thats going to pass. I promise its not. Things are going to get worse. At some point I believe the market will reprice these stocks based on their fundamentals and the gold stocks will show nice growth. I also believe that with increased cash we will see these miners pay dividends far in excess of what treasury bonds are paying and that will attract the pension funds and fixed income investors. When they attempt to get in they have the potential to really drive the market.

Food for thought. The gold market is less than the market cap of Microsoft or Walmart. When the markets discover gold shares then we can talk about a bubble. In the mean time (to quote James Dines) Keep and iron hand on the tiller.

Patience and Margin

– P

PS I will when I get time do this excersize for Goldfields

PPS Im not a security analyst so feel free to point out and flaws in my reasoning here. As usual I welcome constructive critisism.