From a bloomberg article.

Public spending in France accounts for 57 percent of GDP, the second-highest among the world’s richest countries that form the OECD, just behind Denmark.

Over the weekend I read a link from a friends facebook feed. You can find it here.

Anyway I thought about the fact that I drink a cup of coffee most mornings when I get to work and thats it. The rest of the day is water, even in the evening (unless there is wine involved) Then I thought about how much nonsense I must chuck into my body on the weekend when the brandy and coke binges start. Then my mind began to wander as it usually does and I figured its no wonder people are overweight.

I work in an office. Specifically an IT dept and the company I work for has a canteen where staff can buy breakfast lunch and snacks. I rather enjoy having an 8am scone with a helping of butter and jam, not exactly slimming but given that ill run / swim on my lunch break all is good. However what I notice at the canteen is the size of most of the staff frequenting the place. Sure not all resemble jabba the hut but most are overweight. Not the “has a few extra kilos” but properly overweight. People who could lose 10-20kgs and then sill have those few extra kilos to lose.

This got my mind (oddly) to thinking HOW THE HELL DOES THE HUMAN SPECIES REPRODUCE. To all the fat people reading this, are you turned on by your fat rolls engulfing your partner while doing the dirty? Men with huge stomachs, how do you navigate the myriad of awesome fun sexual positions with that sack of fat. As for the women with your huge thighs .. how do you expect us to find happiness in there?

This is my morning rant, now stop reading this and get your fat ass into the gym. Cause nobody wants you looking like that.

aaaaah venting. Its so therapeutic.

|

9:18 AM (0 minutes ago)

|

|

||

|

||||

occasionally gmail misses a spam mail and today I got this gem. Seems legit 🙂

How’s it going?,

I am so happy that you wrote me back! I was waiting every single second for that 🙂 So you are also interested in meeting new interesting people, the most important is to make the first step!

Look, I was going to send you pics of me but the thing is that there is something wrong with my email, so I hang out at this site all the time, http://us.charming-singles.com , there is pretty much everything about me including lots of pictures, you can watch all of them, all you need to do is just make an account, that’s easier than.. whatever the easiest thing is)). There are instant messages so we won’t need to wait for hours for each other! I’m waiting for you, just let me know when you register.

Oh..! I forgot to write my nick, it is ‘lilbeaver23’.

With love,

Cathy

Recently a chap I know returned to SA from a year and some change stint in London. We did the usual catchup, ask what he liked and didnt and then he looked at me (note this was post a couple drinks) and said “So Skinny hows Gold and Silver working out for you” trying to contain his laughter. Recognizing the bait for what it was I chuckled and replied dead seriously. “For the past 18 months since you left its done pretty much nothing with silver going down” So he asked what I was going todo and I said I was going to carry on doing exactly what I was already doing. “Dollar cost averaging in each month” He then proceeded to tell me about a friend he had made who worked at a trading desk for goldman sachs who wouldnt touch the metals and had made good money in the past 2 year period.

This is one example but Ive been asked by more than a few people recently why it is that the metals are doing nothing. Last year was a US election which seems to coincide with lower prices but thats long since over and the US has faced the “sequestration crisis” As I write this cyprus’s banks have been closed over a week and a half and yet gold is under 1600 and silver just a hair over 28. So what gives?

My take is this. The powers that be cant afford to let the metals rise in the face of the currency wars and euro crisis thats currently attempting to unfold. If they do more people will simply leave the banking system and move into things (things being real assets including metal) So there is fierce propaganda about how the crisis is contained how the US is growing and the EU really isnt in such a bad state. People are still buying into this.

Lets look a bit deeper tho. Yes the prices of metals is set on the comex but thats a lot of highly leveraged paper. If one is to look at the physical market we see a different picture entirely. Not only are people buying coins and small bars but country central banks bought 17% more gold in 2012 than in 2011 and 2011 was a record year. My point, follow what they doing not what they saying.

I dont think the bottom is in yet and a retest of 1570 and 27/28 in silver seems highly probable but the gold market seems to be getting into a tighter and tighter range. Sometime (I predict in the next months) the breakout will occur to the up or downside. I believe its going to be to the upside. If you have to ask why then clearly you’re new to this and ill put it simply. Would you rather have paper money in the bank backed by nothing or chunk of gold whose value has never gone to zero in the 4000 years of recorded history? Put another way, gold is the only asset that isnt simultaneously someone else’s liability!

Dont come crying when your government steals your paper assets 🙂

– P

http://www.zerohedge.com/news/2013-02-09/after-freezing-prices-argentina-bans-all-advertising

Ive been watching whats been going on in Argentina for a while and everything has been playing out in a very predictable manner. The country under reports inflation, prints money to pay its obligations and cheapens the currency to “promote exports” As history shows this policy never works yet governments, refusing to make the difficult decisions lest they be voted out of office, follow the same failed policies every time.

Japan has openly said its going to print money to cheapen the Yen. The swiss are prattling on about how their currency is too strong, the US are somewhat surreptitious in their role. They are printing huge amounts of money to buy up mortgage backed securities and treasuries. It amounts to the same thing they just sell it on “saving the mortgage lenders” etc etc. You cant devalue your way to prosperity. Its happening in every country around the world. Its in the stealth phase in many countries right now. People are feeling inflation but its not bad enough that they want to do anything about it other than complain.

Gold and silver have done nothing for 18 months now and there is still the talk that the metals bull market is over. To that I call bullshit, when inflation starts to show up in the official numbers watch them fly.

As an aside Venezuela this past weekend devalued the currency by 30% overnight. This will happen in Argentina before long as well and can easily happen in your country.

I know what Im doing to protect my wealth from the paper collapse. Do you?

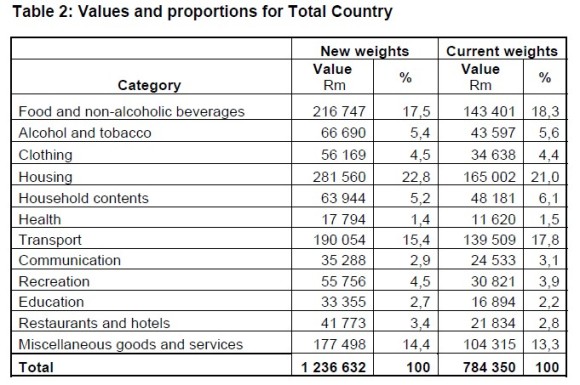

Lets look at this table representing country wide and then a second table for urban areas and discuss

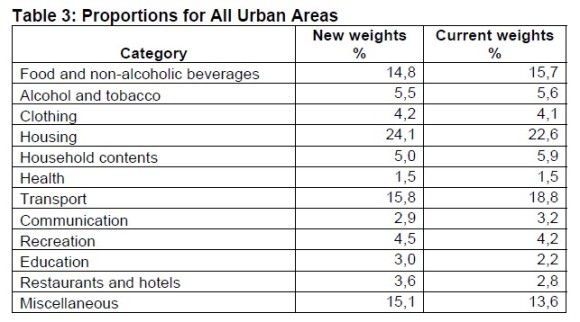

This is the table for urban arears

These two tables came out of PDF from stats SA released 6 november while the rest of the world was obsessing over who would win the US presidential election. Something thats pretty pointless because niether candidate is going to make a difference but I digress.

Looking above on both tables something strikes me as plain wrong. The CPI basket is supposed to represent what the average south african spends his money on. Now I dont consider myself the average south african as I am fortunate to be earning more than average (I pay tax and taxpayers are in the minority – I could be wrong tho …) If Im correct in my assumption it means ill have more left over having bought essentials to splurge on holidays, toys, clothes I dont needs, booze and so forth.That said my biggest 3 costs every month in this order are, Food, Rent, Transport (car + Fuel) I think for the average person this is about right although for some older people such as my mother her medical insurance(s) come in at number 1. For me its 4.

Does it seem correct then that if the average person spends most of their money on food, energy, housing and health that the weighting of those should be reduced? (Except housing that did get revised up) The things people need most that are going up most are having their weighting reduced.

Lets look at this another way. Take your monthly budget. Are you telling me you spend 14.8% on food and 15.1% on “Misc” Items? This folks is how they cook the numbers. They have some other fun tricks like substitution and hedonics as well but for now we’ll just look here at weightings. So when the inflation numbers stay within the SARB’s 3-6% target range and your cost of living is somehow higher you know why.

The cruel irony here is that they will point to the low inflation numbers as good for the economy and for the people. The poor masses and middle class will lap those headlines up like a cat does milk. Yet THEY are the ones who are worst affected by the stealthy inflationary tax. Money managers will release year en results and say “We grew our clients money by 12% double the rate of inflation” (And thats if you are licky) Meanwhile inflation is closer to 12-15% so your money at best kept pace with inflation. The evil rich however will be buying assets that protect them from this inflation and the gap between the rich and poor will grow.

So I ended up having a bit of a rant as usual. But my message is simple. Question everything, dont take it at face value. Any correlation between the change in your cost of living and the CPI numbers are purely coincidental 🙂

-P