SA re weights its CPI basket – what does this mean to you

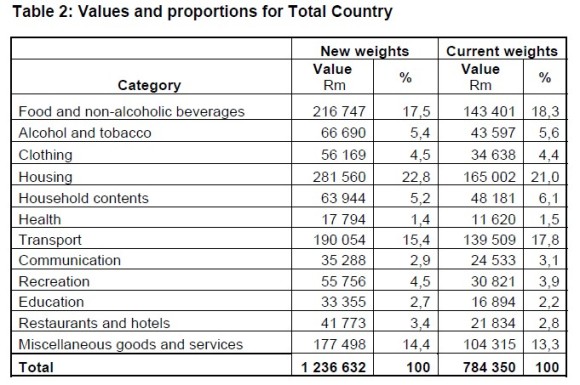

Lets look at this table representing country wide and then a second table for urban areas and discuss

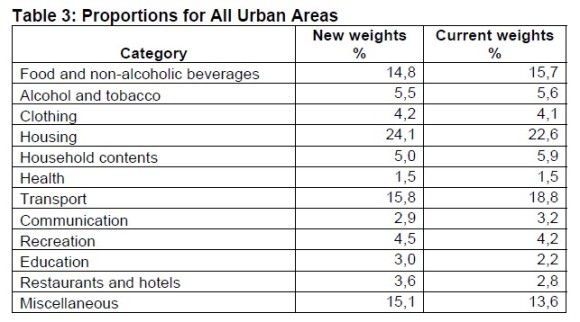

This is the table for urban arears

These two tables came out of PDF from stats SA released 6 november while the rest of the world was obsessing over who would win the US presidential election. Something thats pretty pointless because niether candidate is going to make a difference but I digress.

Looking above on both tables something strikes me as plain wrong. The CPI basket is supposed to represent what the average south african spends his money on. Now I dont consider myself the average south african as I am fortunate to be earning more than average (I pay tax and taxpayers are in the minority – I could be wrong tho …) If Im correct in my assumption it means ill have more left over having bought essentials to splurge on holidays, toys, clothes I dont needs, booze and so forth.That said my biggest 3 costs every month in this order are, Food, Rent, Transport (car + Fuel) I think for the average person this is about right although for some older people such as my mother her medical insurance(s) come in at number 1. For me its 4.

Does it seem correct then that if the average person spends most of their money on food, energy, housing and health that the weighting of those should be reduced? (Except housing that did get revised up) The things people need most that are going up most are having their weighting reduced.

Lets look at this another way. Take your monthly budget. Are you telling me you spend 14.8% on food and 15.1% on “Misc” Items? This folks is how they cook the numbers. They have some other fun tricks like substitution and hedonics as well but for now we’ll just look here at weightings. So when the inflation numbers stay within the SARB’s 3-6% target range and your cost of living is somehow higher you know why.

The cruel irony here is that they will point to the low inflation numbers as good for the economy and for the people. The poor masses and middle class will lap those headlines up like a cat does milk. Yet THEY are the ones who are worst affected by the stealthy inflationary tax. Money managers will release year en results and say “We grew our clients money by 12% double the rate of inflation” (And thats if you are licky) Meanwhile inflation is closer to 12-15% so your money at best kept pace with inflation. The evil rich however will be buying assets that protect them from this inflation and the gap between the rich and poor will grow.

So I ended up having a bit of a rant as usual. But my message is simple. Question everything, dont take it at face value. Any correlation between the change in your cost of living and the CPI numbers are purely coincidental 🙂

-P